georgia property tax exemption codes

County Property Tax Facts. New signed into law May 2018.

New Resident Cobb Taxes Cobb County Tax Commissioner

Apply for a Homestead Exemption.

. Property Tax Homestead Exemptions. 2-204 Construction Application and Severability. H6 This has a household income limit of 15000 Georgia Net Income.

The value of the property in excess of this amount remains taxable. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem taxThe taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the Title Ad Valorem Tax FeeTAVT. A homestead exemption can give you tax breaks on what you pay in property taxes.

Items of personal property used in the home if not held for sale rental or other commercial use. The general rule for all exemptions is. Your cars must be registered in Augusta-Richmond County and you must not claim homestead on any other property.

Part 1 - Tax Exemptions. A homestead exemption can give you tax breaks on what you pay. Georgia exempts a property owner from paying property tax on.

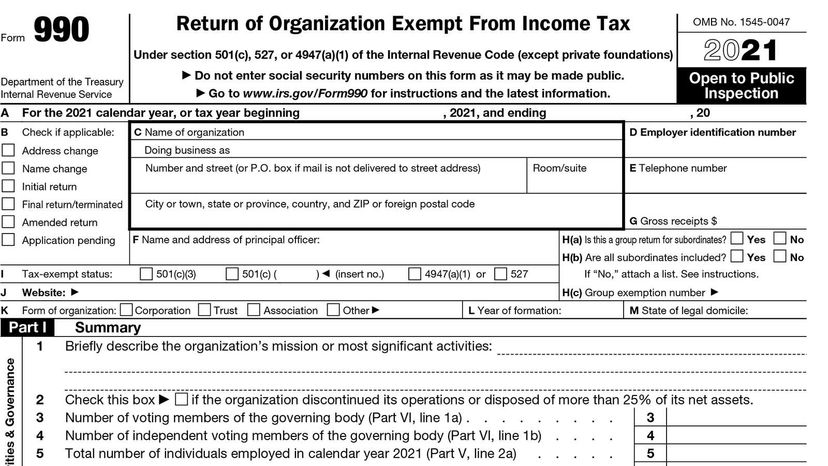

The owner of the property must be a non-profit organization a copy of your IRS 501c3 award letter will be requested. For information in regard to the Exemptions listed below please call the Tax Assessors office at 770-288-7999 opt. GA Code 48-5-41 2016 a The following property shall be exempt from all ad valorem property taxes in this state.

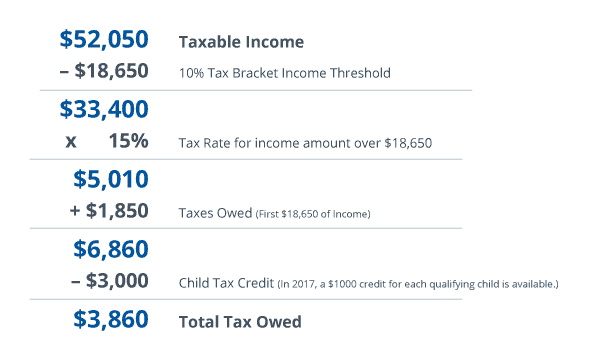

It increases the exemption to 16500 for school taxes and 14000 for county levies. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16. State and federal government websites often end in gov.

GA Code 48-5-482 2019. While the state sets a minimal property tax rate each county and municipality sets its own rate. Georgia counties rely on the property tax to sustain governmental services.

Veterans Exemption - 100896 For tax year 2021 Citizen resident of Georgia spouse of a member of the armed forces of the US which member has been killed in any war or armed conflict in which the armed forces of the US. Property Tax Proposed and Adopted Rules. Property Tax Millage Rates.

These exemptions are based on age and income. 1 A Except as provided in this paragraph all public property. A tax district is a geographical grouping of property within which an authority such as a county board of commissioners a school board or a city council have.

Vehicle Registration - Vehicle owners must renew their. The following list sets forth the. Domestic animals in an amount not to exceed 300 in actual value.

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description. Property taxes are the cornerstone of local neighborhood budgets. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

It increases the exemption to 22500 for school taxes and 14000 for all county levies. ARTICLE II - Chatham County Code of Ethics. H8 This has a household income limit of 16000 Gross Income.

The following Exemptions must be filed at the Tax Assessors Office. The Georgia Code grants several exemptions from property tax. 2-207 Conflict of Interest.

All tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value. The additional sum is set by the US Secretary of Veterans Affairs. Property exempt from taxation.

2-202 Declaration of Policy. Widowed un-remarried spouse of police officers and firefighters killed in the line of duty may be exempt from all ad. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence.

Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law.

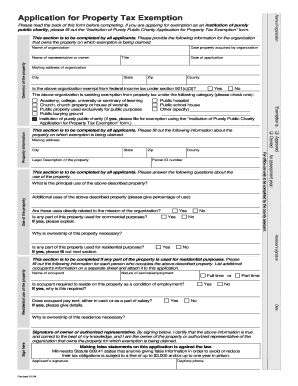

Level 1 freeport exemption. What types of real property have been granted an exemption from Georgias property tax. Each county has different applications and required documents.

I am 65 years old or older. Qualifying disabled veterans may be granted an exemption of 60000 plus an additional sum from paying property taxes for county municipal and school purposes. You must file with the county or city where your home is located.

In 2018 its 81080. The Tax Digest Consolidated Summary herein referred to as consolidation sheets depicts the assessed totals of all property listed on a Georgia countys tax digest separated by tax district. I am 62 to 64 years old.

Property Tax Returns and Payment. You may qualify for the S1 exemption. Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter.

2019 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-482. 23 rows CITY OF ATLANTA HOMESTEAD EXEMPTION QUALIFICATION Code. Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment plants public safety services transportation and more.

Other Personal Property Exemptions. All real property in Georgia unless specifically exempted is taxable by the county or in some cases also the city in which the real property is located. 2-205 Compliance with Applicable Law.

Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. COOPF 0 COOP - Fulton County S1 Regular Homestead HF01 2000 Fulton Homestead Reg S1 Regular Homestead HF01U1 2000 HF01 UE1 S1 Regular Homestead HF01U2 2000 HF01 UE2 S1 Regular Homestead HF01U3 2000 HF01 UE3 S1 Regular. You may qualify for the H2A or S4 exemption.

B No public real property which is owned by a political subdivision of this state and which is situated outside. The exemption is 50000 off. You may qualify for the S3 exemption.

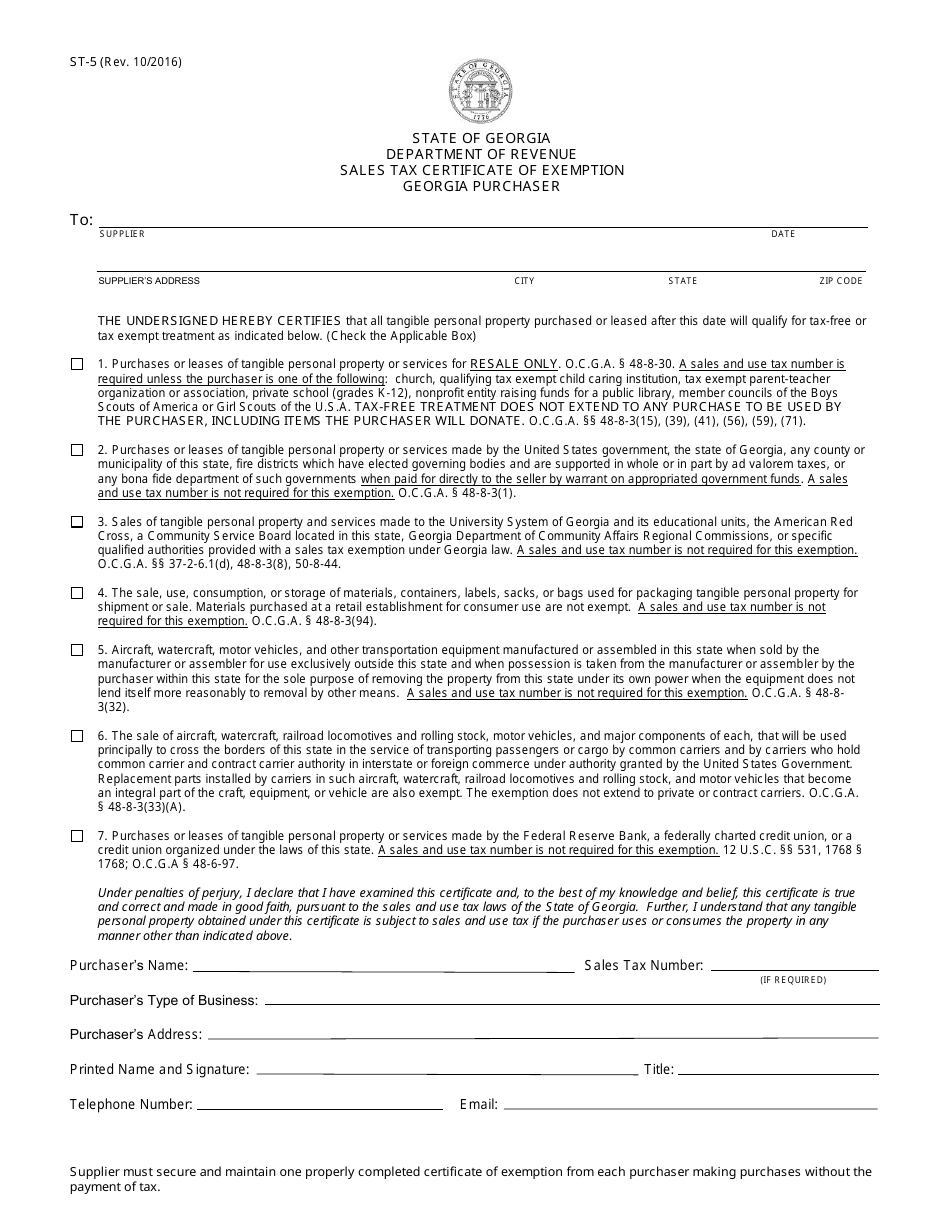

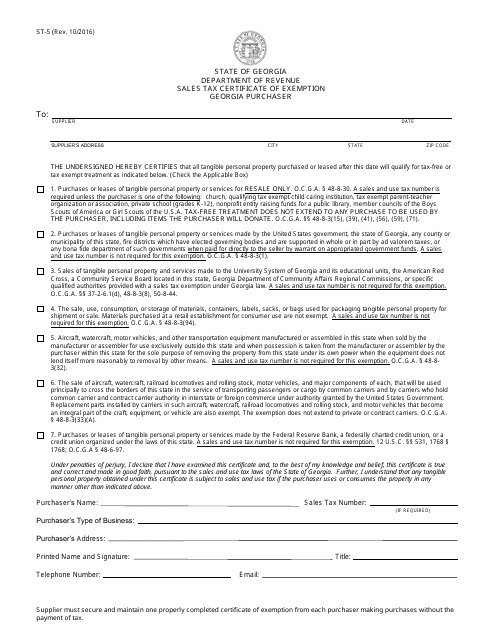

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online

Legislation To Provide Senior Homestead Tax Exemption In Bartow Receives Final Passage In Georgia Senate Allongeorgia

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Every Year We Rank The Best States For Solar Power And The Worst Learn All About State Solar Policy And Incentives Li Solar Power Solar Data Visualization

How To Get A Sales Tax Exemption Certificate In Utah

10 Ways To Be Tax Exempt Howstuffworks

Tax Benefits Of Owning Rural Land In 2021 Estimated Tax Payments Tax Deductions Business Tax Deductions

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

Minnesota Property Tax Exemption Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller